XRP Price Prediction: 2025-2040 Outlook Amid Regulatory Clarity and ETF Momentum

#XRP

- Regulatory clarity following the SEC case dismissal removes major uncertainty and opens doors for institutional adoption

- ETF development momentum and potential approval could drive significant institutional capital inflows

- Technical indicators show bullish momentum with MACD crossover and strong support levels holding

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum with Key Indicators

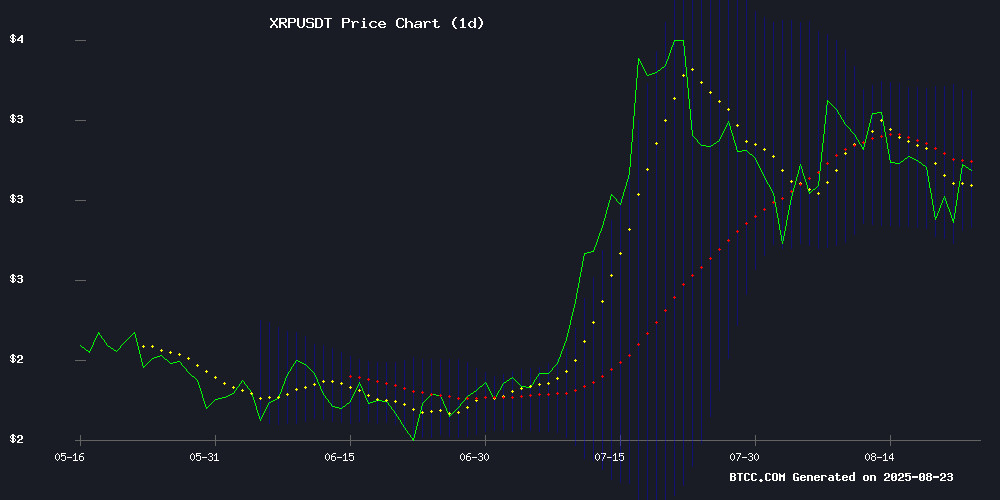

XRP is currently trading at $3.032, slightly below its 20-day moving average of $3.0948, indicating potential consolidation. The MACD reading of 0.0772 versus 0.0269 shows bullish momentum building, with the histogram at 0.0502 confirming upward pressure. Bollinger Bands position the upper band at $3.3577 and lower at $2.8320, suggesting room for movement toward resistance levels. According to BTCC financial analyst Mia, 'The technical setup suggests XRP is building momentum for a potential breakout above the $3.10 level, with the MACD crossover providing additional bullish confirmation.'

Market Sentiment: XRP Benefits from Regulatory Clarity and ETF Momentum

Recent developments have created overwhelmingly positive sentiment for XRP. The dismissal of appeals in the Ripple vs SEC case provides crucial regulatory clarity, while multiple asset managers amending spot XRP ETF filings indicate institutional confidence. BTCC financial analyst Mia notes, 'The combination of legal resolution and ETF developments creates a perfect storm of positive catalysts. The 9% surge before pullback to $3 demonstrates strong market appetite, and Gemini's XRP-linked Mastercard tease suggests expanding utility.' News of Ripple's CEO calling this a 'new dawn' for crypto policy and the CTO teasing major ledger upgrades further reinforces the bullish narrative for long-term adoption.

Factors Influencing XRP's Price

XRP Grabs Attention with Significant Price Surge

XRP surged roughly 10% in a single day, drawing intense market scrutiny. A whale transferred $50 million worth of tokens to an exchange, signaling potential profit-taking or strategic repositioning amid the rally.

Macroeconomic tailwinds fueled the broader crypto market uptick, with XRP benefiting disproportionately. Analysts note improving risk appetite and favorable regulatory developments as key catalysts.

The ongoing Ripple-SEC lawsuit continues to cast a shadow, though recent price action suggests traders are betting on a favorable resolution. Large transfers typically precede volatility—market makers are adjusting positions accordingly.

Asset Managers Amend Spot XRP ETF Filings Following SEC Feedback

Grayscale, Bitwise, and a cohort of other prominent asset managers—including Canary, CoinShares, Franklin Templeton, 21Shares, and WisdomTree—submitted revised proposals for spot XRP exchange-traded funds on Friday. The synchronized amendments suggest active engagement with the Securities and Exchange Commission, signaling potential progress toward regulatory approval.

Key structural changes emerged in the filings, notably shifting from cash-only creations to permitting XRP or cash for creations and redemptions. "Highly notable to see them cluster like this," observed Nate Geraci of NovaDius Wealth, framing the coordinated updates as a bullish indicator for institutional crypto adoption.

Bloomberg ETF analyst James Seyffart noted the filings likely reflect SEC feedback, calling the developments "expected but positive." Market participants now watch for whether these operational tweaks satisfy regulators' concerns about in-kind transactions in the $28 billion XRP market.

XRP's Potential Surge as the Premier Asset for Global Remittances

XRP could reach double-digit valuations if it becomes the dominant cryptocurrency for cross-border family remittances. Designed for instant, low-cost settlements, XRP transactions settle in seconds with fees as low as a fraction of a cent—a stark contrast to traditional payment systems.

Financial institutions are already leveraging XRP's efficiency. Santander Bank, SBI Holdings, and Bank of America are among the adopters highlighted by Bitrue last month. With global remittances hitting $860 billion in 2023, XRP's circulating supply positions it for exponential growth if it captures even a fraction of this market.

India's $125 billion remittance inflow—the world's largest—exemplifies the scale of opportunity. XRP's ledger technology isn't just theoretical; it's battle-tested and institutionally endorsed. The gap between current utility and future potential is where speculation meets fundamentals.

XRP Surges 9% Before Pullback Caps Rally Near $3

XRP surged 9% during the August 22-23 trading session, testing multi-month resistance near $3.10 after weeks of sideways movement. The rally coincided with dovish remarks from Federal Reserve Chair Jerome Powell at Jackson Hole, which bolstered expectations of a September rate cut and lifted risk appetite across digital assets.

On-chain settlement volumes on the XRP Ledger spiked 500% earlier this week, fueling optimism about institutional adoption despite ongoing whale distribution. The token swung between $2.79 and $3.10, marking an 11% intraday range before settling near $3.01.

Technical analysis highlights a breakout from the $2.84-$2.97 accumulation zone, with strong resistance forming at $3.08-$3.10. Support has consolidated around the $2.97-$3.00 psychological level, defended repeatedly during the session.

Blockchain Consultant Advises XRP Millionaires on Wealth Preservation Strategies

As XRP price predictions reach speculative heights—with targets ranging from $100 to $10,000 per token—investors are calculating the holdings required to achieve million-dollar portfolios. A $30,000 position today could theoretically yield $1 million if XRP hits $100, while even a $300 investment might reach that threshold at $10,000.

Blockchain consultant Armando Pantoja warns that bull market windfalls often evaporate within 18 months. "Real wealth isn't made by hitting arbitrary price targets," he observes, "but by converting gains into sustainable income streams without eroding principal." His commentary emphasizes structured wealth management over speculative trading.

The analysis spotlights a growing divide between crypto's get-rich-quick narratives and institutional-grade asset preservation techniques. While XRP's extreme price targets remain contentious, Pantoja's framework applies universally: compound through yield-bearing instruments, diversify across asset classes, and prioritize capital preservation.

U.S. Court Officially Ends Ripple vs SEC Case With Dismissal of Appeals

The U.S. Second Circuit Court has formally dismissed both the SEC's appeal and Ripple's cross-appeal, marking the conclusion of a nearly five-year legal battle. A one-page court document confirms the withdrawal of appeals, with Clerk Catherine O'Hagan Wolfe noting the stipulation is "So Ordered."

The SEC had challenged Judge Analisa Torres' ruling that programmatic sales of XRP did not constitute investment contracts, while Ripple contested the $125 million penalty imposed for institutional sales. The dismissal removes lingering uncertainty around XRP's regulatory status.

GMO Miner Users Earn Steady $6,800 Daily Amid XRP Volatility

XRP's price volatility has dominated recent market headlines, with the token plunging to $2.79 on August 22—its lowest level this month. The drop briefly cost XRP its position as the third-largest cryptocurrency by market cap, as investor sentiment wavered amid large-scale liquidations.

Against this backdrop, cloud mining emerges as a compelling alternative for stable returns. GMO Miner, a UK-based platform launched in 2020, reports users consistently earning $6,800 daily through its infrastructure. The service eliminates hardware costs and management fees while offering instant $15 sign-up bonuses.

"Our mission is democratizing blockchain wealth creation," the company states, highlighting its intelligent algorithms and global compute network. The platform caters to both novice and experienced miners seeking insulation from market swings.

XRP Poised for Significant Upswing Amid ETF Momentum and Legal Clarity

XRP is showing strong bullish signals as institutional interest surges following the resolution of Ripple Labs' legal battle with the SEC. Multiple asset managers, including Grayscale and Franklin Templeton, have updated their XRP ETF filings, with approval odds now estimated at 85%.

The XRP Ledger ecosystem continues to expand, with RLUSD approaching $700 million in assets and transaction volume jumping 15% to $2.7 billion. Technical analysts highlight a potential breakout from an 8-year downtrend against Bitcoin, fueled by upcoming XRPL upgrades and strategic partnerships.

Market observers point to a developing bull flag pattern reminiscent of November 2024's rally, when XRP surged from $1.13. ETF expert Nate Geraci describes the coordinated filings as "a very good sign," while existing XRP-focused ETFs have already attracted hundreds of millions in assets.

Gemini Teases XRP-Linked Mastercard Amid Price Surge Past $3

Ripple's XRP has re-entered the crypto spotlight as speculation mounts over a potential XRP-branded Mastercard launch by Gemini. The exchange's cryptic billboard in New York City, bearing the message "Prepare your bags" and dated August 25, 2025, has ignited rumors of an upcoming payment card partnership. XRP's price surge beyond $3 coincides with this development, fueling optimism about its mainstream adoption.

While Gemini remains officially silent, industry observers note the exchange's existing crypto rewards card infrastructure could facilitate a swift XRP integration. Unverified reports suggest a three-way collaboration between Ripple, Gemini, and Mastercard, with WebBank potentially serving as the compliant card issuer. Crypto attorney John Deaton has amplified the discussion by engaging Gemini's co-founders publicly.

The market response reflects growing confidence in XRP's utility, bolstered by recent legal clarity and ETF speculation. Payment card integration would mark a significant step toward real-world cryptocurrency applications, though skeptics caution against premature celebration without official confirmation.

Ripple CEO Calls It a “New Dawn” as U.S. Policy Warms to Crypto

The U.S. regulatory landscape for cryptocurrency is undergoing a seismic shift, with industry leaders like Ripple CEO Brad Garlinghouse heralding a "new dawn" for digital assets. Speaking at the Wyoming Blockchain Symposium, Garlinghouse noted a dramatic change in tone among policymakers, including Federal Reserve governors openly endorsing blockchain technology.

Legal advocate John Deaton echoed this sentiment, describing the reversal from regulatory crackdowns like "ChokePoint 2.0" to a path toward mass adoption as a "180-degree turn." The shift signals growing institutional acceptance of cryptocurrencies like XRP, marking a pivotal moment for the industry.

Ripple CTO Teases Major XRP Ledger Upgrade Amid Flawless Testing

Ripple's Chief Technology Officer David Schwartz has unveiled a critical infrastructure upgrade for the XRP Ledger, with production deployment expected as early as next week. The enhancement focuses on the network's hub server architecture - a backbone component that has demonstrated three days of uninterrupted operation during stress tests.

The update specifically targets peer connectivity robustness, aiming to eliminate synchronization drops during high-traffic periods. Initial metrics show bandwidth consumption remaining within safety thresholds while maintaining stable peer connections, with only minor latency fluctuations observed under heavy outbound loads.

This marks the latest in a series of technical improvements to the XRP Ledger since its 2012 launch, reinforcing its reputation for enterprise-grade reliability. Market observers note the timing coincides with growing institutional interest in blockchain payment solutions.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, XRP appears positioned for significant growth through 2040. The resolution of regulatory uncertainty and growing institutional adoption through ETF products create a strong foundation. BTCC financial analyst Mia provides this outlook: 'We're seeing a convergence of technical strength and fundamental catalysts that could drive XRP to new heights over the next 15 years. The recent legal clarity removes a major overhang, while ETF developments open doors for broader institutional participation.'

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $4.50-$5.20 | $5.80-$6.50 | $7.00-$8.00 | ETF approvals, remittance adoption |

| 2030 | $12-$15 | $18-$22 | $25-$30 | Global regulatory clarity, banking integration |

| 2035 | $30-$40 | $45-$60 | $70-$85 | Mass adoption, ledger upgrades |

| 2040 | $80-$100 | $120-$150 | $180-$250 | Full ecosystem maturity, global standard |